Title loan storefronts are vital hubs offering personalized service, transparent pricing, and immediate approvals using vehicle titles as collateral. Easily found via online directories like Google Maps, these stores cater to individuals with less-than-perfect credit and provide access to funding, including specialized loans like boat title loans. Conduct an online evaluation checking for fair practices, customer reviews, and clear pricing before visiting a potential storefront.

Looking for quick cash? Title loan storefronts offer a convenient option with their physical presence. This guide helps you navigate and locate these valuable resources. We’ll explore why understanding title loan storefronts is key, and provide practical tips on identifying and evaluating them in your area. Discover how to access fast funding by knowing where to find these specialized locations near you.

- Understanding Title Loan Storefronts and Their Importance

- Identifying and Locating These Facilities Near You

- Tips for Evaluating a Title Loan Storefront Before Visiting

Understanding Title Loan Storefronts and Their Importance

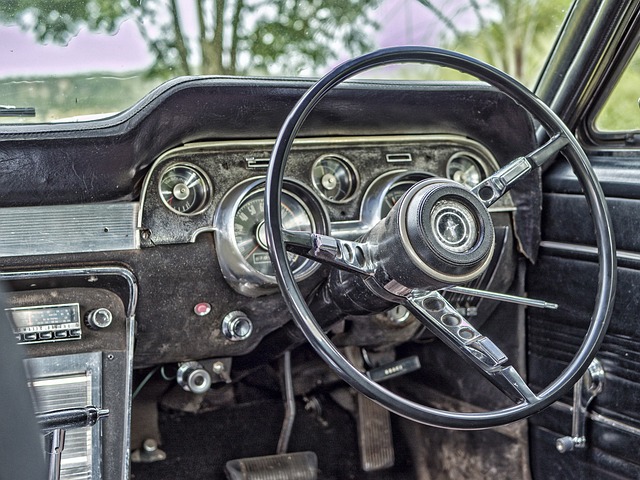

Title loan storefronts are physical locations where individuals can access short-term financing by using their vehicle’s title as collateral. These stores play a crucial role in providing quick cash solutions for those in need, especially when traditional banking options may be limited or inaccessible. By visiting a title loan storefront near you, borrowers can benefit from personalized service and immediate approvals, making it an attractive alternative for emergency funding.

Understanding the importance of these locations goes beyond convenience. Title loan storefronts often offer transparent pricing, including interest rates displayed prominently, allowing customers to make informed decisions. Additionally, they conduct thorough vehicle inspections to determine the loan amount, ensuring a secure lending process. Unlike some online lenders, many title loan storefronts do not perform extensive credit checks, making it easier for individuals with less-than-perfect credit to gain access to much-needed funds. This accessibility is particularly valuable in areas where financial services are scarce, empowering folks to manage unexpected expenses or seize opportunities without the usual barriers.

Identifying and Locating These Facilities Near You

Identifying and locating title loan storefront locations near you is a straightforward process thanks to modern technology. Online directories, such as Google Maps, offer detailed search tools that allow users to filter for specific services like “title loan storefronts” within their vicinity. This method provides an easy way to see nearby options, often displaying user reviews and ratings for each location, helping you make an informed decision.

Additionally, many title lending companies have made their services more accessible by offering remote applications and digital documentation, along with the convenience of same-day funding. Some even specialize in unique types of loans like boat title loans, ensuring that if you need a quick loan, you can keep your vehicle while still accessing the funds you require promptly.

Tips for Evaluating a Title Loan Storefront Before Visiting

Before visiting a potential title loan storefront location, take some time to evaluate and research the establishment to ensure it’s reputable and aligns with your needs. Start by checking their online presence; many stores have websites detailing their services, terms, and contact information. Look for transparent pricing structures, including interest rates and any associated fees, as this can significantly impact the overall cost of your loan.

Additionally, consider the variety of loan options they offer. Are they specialized in Dallas Title Loans or open to other asset-based loans like Boat Title Loans? Understanding their expertise and the types of borrowers they cater to is essential. Read customer reviews to gauge satisfaction levels and identify any red flags. Reputable stores often have positive feedback from previous clients, highlighting fair practices, quick turnaround times, and helpful staff.

Locating a suitable title loan storefront near you is now simpler than ever. By understanding these specialized financial institutions and their role in providing quick cash solutions, you can make informed decisions. With the right tools and knowledge, identifying nearby title loan stores becomes effortless. When evaluating potential lenders, consider factors like reputation, transparency, and customer reviews to ensure a positive experience. Remember, access to emergency funds is just around the corner when you know where to find these valuable resources.